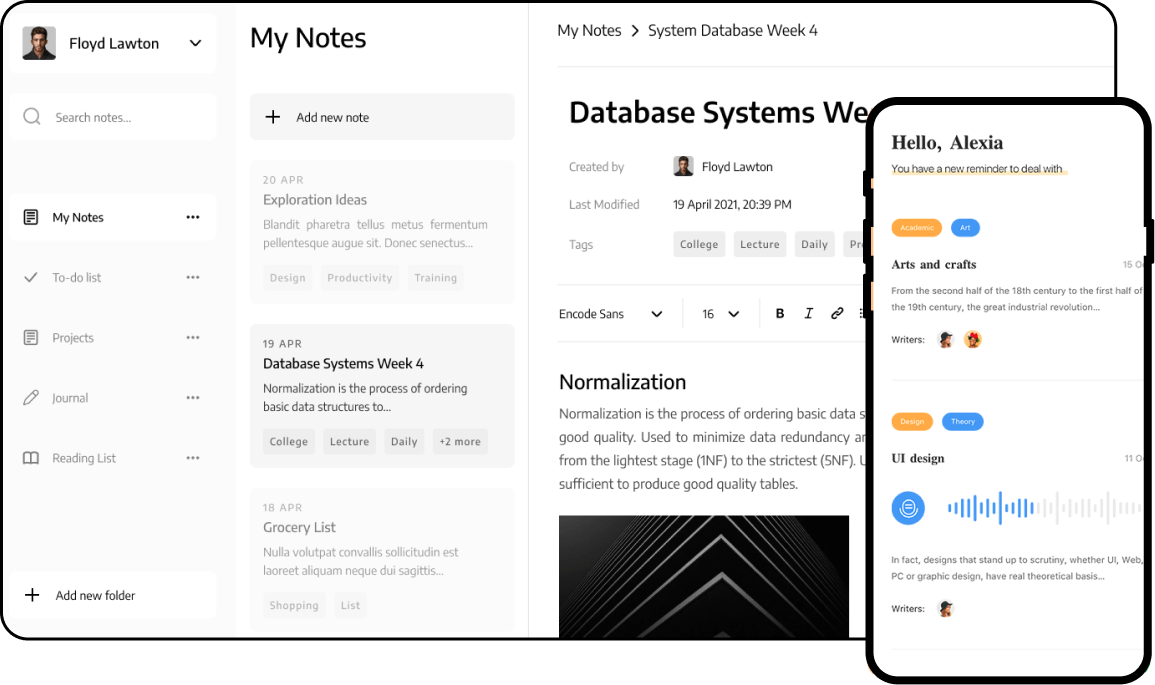

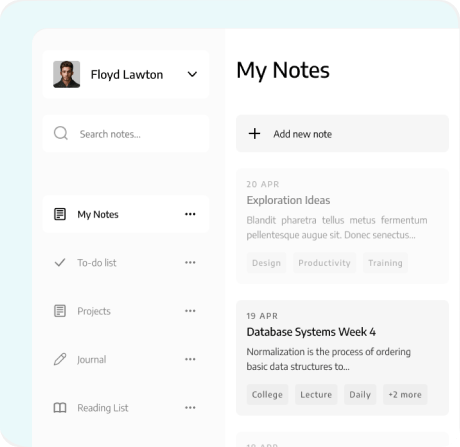

First Step

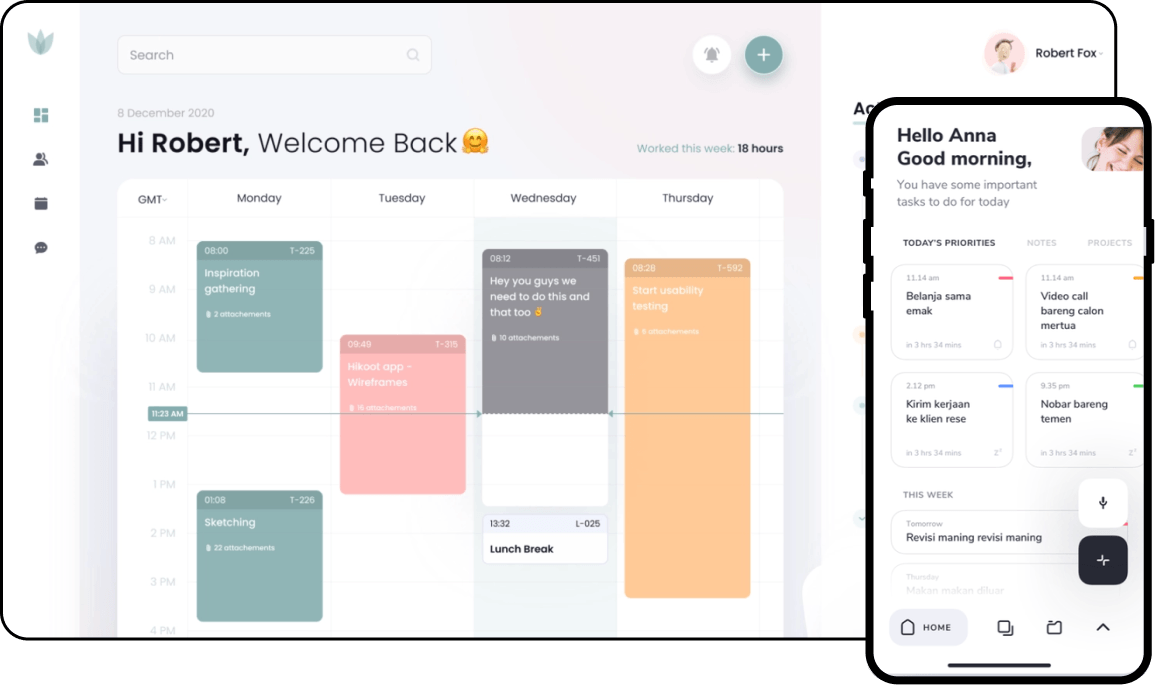

Choose Your Loan Type

Assess our wide range of loan products to meet your personal financing; select the one that suits your needs best.

Powering Your Financial Success with Industry Leaders

First Step

Assess our wide range of loan products to meet your personal financing; select the one that suits your needs best.

Second step

Fill out our simple and secure online form with all the required details to kickstart the process.

Third Step

Our experts review your application promptly – open quick approval process.

All Done Hooray!!!!

Kind words from our YoloCredit Clients.

YoloCredit made my home buying journey incredibly smooth. Their quick approval process and competitive rates helped me secure my dream home within weeks. The customer service team was supportive throughout!

As a small business owner, I needed quick capital for expansion. YoloCredit not only provided the business loan I needed but also offered flexible repayment terms that worked perfectly for my cash flow.

I was skeptical about online loans until I tried YoloCredit. Their transparent process and zero hidden fees were refreshing. Got my personal loan approved in just 24 hours!

Already closed 1 deal from Accelerator and in the process of closing 2 more now. Have “a few others” that will be closing in the near future!

The education loan from YoloCredit helped me pursue my master's degree. Their team guided me through every step, making the entire process stress-free. Couldn't be more grateful!

FAQ’s

Yolo Credit offers a wide range of loans, including home loans, personal loans, education loans, business loans, car loans, and gold loans. Each loan is designed to cater to specific financial needs.

The loan approval process is quick and streamlined. Once you submit the necessary documents and application, approvals can be processed instantly or in a few business days, depending on the loan type.

Typically, you will need:

Proof of identity (e.g., Aadhaar card, PAN card, or passport)

Proof of address (e.g., utility bill, rent agreement)

Income proof (e.g., salary slips, bank statements, or IT returns)

Specific documents based on the loan type (e.g., property papers for a home loan, car details for a car loan).

Yes, you can easily apply for a loan online through the Yolo Credit website. The process is user-friendly, allowing you to select your loan type, submit your application, and track its progress.

No, Yolo Credit is committed to transparency. All applicable charges, including processing fees or interest rates, are clearly communicated during the application process. There are no hidden charges.

Make your dream of owning a reality with our affordable and customizable home loans.

Flexible loan options with minimal paperwork from education to renovations.

Secure your future with easy financing for higher education and training programs.

Scale your business with tailored funding solutions for expansion or working capital.

+91 8309665795

support@yolocredit.in

Banglore - India

Contact Us for a Free -Consultation